Dwelling Flex

Storm after storm, year after year®, we are here for you. We have options for every homeowner.

About Insurance

Dwelling Fire Insurance for Homeowners

The Dwelling Fire Owner (DF3-DO) policy is considered à la carte because it offers more flexibility than a standard homeowners insurance policy. Despite the name, this policy has the option to cover more than fires. A Dwelling Fire Owner policy provides coverage for an owner-occupied home. The Dwelling Fire Owner policy has a variety of optional coverages that you may choose to include. A few examples of the optional coverages available in this program are personal property replacement cost, ordinance or law, theft, liability, and medical payments coverage.

Looking for Information on Coverage Options?

Your insurance agent can provide a complete list of the coverage options available in this program. So, you can make the coverage selections that best suit your insurance needs.

Are you a Landlord?

We also offer Dwelling Fire Insurance for landlords of homes (e.g. single-family homes) and condo units.

Our Dwelling Fire Coverage for Homeowners Insurance Plan Includes

Many coverages have a minimum and maximum coverage amount (commonly referred to as “coverage limit”). Each of the coverage tabs below provide a basic overview of the coverage and the applicable coverage limits that allow you to customize your policy to best suit your needs.

DF3-DO Coverage for the

Structure of Your Home

A Dwelling Fire Owner policy provides coverage for damage to the structure—your home—in the event of a covered loss. Coverage A includes replacement cost for covered losses. This means that the structure of your home is valued using today’s construction costs to rebuild or repair your home, which is not the same as the real estate value of your home.

Homes with an older roof that may not be eligible for a standard Homeowners Insurance policy could be eligible for a Dwelling Fire Owner policy because the Dwelling Fire program has a Roof Surfaces Payment Schedule that can be added to the base policy.

Dwelling (Coverage A) Limit: $125,000 – $1,000,000

A higher minimum coverage limit applies to properties located in certain counties.

DF3-DO Coverage for

Other Structures

Our Dwelling Fire Owner policy provides coverage for “other structures” located on the residence premises. For example: a detached garage or an in-ground swimming pool may be considered an “other structure”. Additional coverage is also available for pool enclosures.

Other Structures (Coverage B) Limit: 1% – 20% of Coverage A

DF3-DO Coverage for

Your Contents

Coverage C provides coverage for your personal belongings. Some examples of the contents you may elect to cover are furniture, clothing, jewelry, television, stereo, and appliances.

Personal Property (Coverage C) Limit: $0 – $250,000

Optional replacement cost coverage for your personal property allows you to replace or repair items that were damaged or destroyed based on current market prices. Without this coverage, your items will be valued at actual cash value (ACV), which is generally less than the cost of a new item. ACV is more like the price you’d see at a garage sale. We recommend purchasing replacement cost coverage for your belongings.

DF3-DO Coverage if

Fair Rental Value & Additional Living Expense

If your home becomes uninhabitable due to a covered loss, our Dwelling Fire Owner policy provides coverage for the additional living expenses you and your family incur while you are living away from your home. This includes costs for a place to stay, food, and clothing.

Coverage D & E Limits: 10% of Coverage A

Tip: Make sure you keep all your receipts.

In the event of a covered loss, we provide a pre-paid debit card that you can begin using right away to cover those additional, unexpected expenses. This eliminates the hassle of having to deposit a check and will allow you to withdraw the cash you need immediately upon activation. This is one of the many solutions we’ve put in place to improve the customer experience with Security First Insurance.

DF3-DO Coverage for

Personal Liability on Your Property

This coverage provides protection if someone were to file a lawsuit against you, claiming you caused them bodily injury or damaged their property. Liability can protect you in situations that may be unforeseen, such as a friend twisting their ankle on a loose step. Liability coverage also covers certain defense costs—even if the lawsuit filed against you is false, groundless or fraudulent.

Personal Liability (Coverage L) Limits: $0, $100,000, $200,000, $300,000, or $500,000

DF3-DO Coverage for

Medical Payments

This coverage is paired with Personal Liability coverage to provide medical expense coverage to others (not living at your residence) who are injured on your property, or who incur injuries resulting from your personal activities.

Medical Payments (Coverage M) Limits: $0, $1,000, $2,500, or $5,000

Optional Add-Ons

- Aluminum Screened Enclosures & Carport

- Identity Theft Protection & Monitoring

- Personal Property Replacement Cost

- Ordinance or Law

- Personal Property Theft

- Permitted Incidental Occupancy

- Equipment Breakdown & Service Line Endorsements

- Water Back Up and Sump Overflow

- Golf Cart Physical Damage and Liability

- Computer Equipment Endorsement

- Dog Liability

- Scheduled Personal Property

Compare Our Plans

Choosing the right coverage can be overwhelming with so many options available. Use the chart below to compare our most popular policies and find the one that fits your needs.

- Dwelling Flex (DF3-DO)

- Signature & Signature+ (HO3)

- Condo (HO6)

- Landlord Flex (DF3-DL)

- Premier (HO5)

‡ Four-night minimum required (DF3-DL)

† Two-night minimum required (HO6, DF1)

‡ Four-night minimum required (DF3-DL)

- Dwelling Flex (DF3-DO)

- Signature & Signature+ (HO3)

- Condo (HO6)

- Landlord Flex (DF3-DL)

- Premier (HO5)

‡ Four-night minimum required (DF3-DL)

† Two-night minimum required (HO6, DF1)

‡ Four-night minimum required (DF3-DL)

Additional Coverage Options

Our flexible coverage options, knowledgeable agents, and exceptional customer service ensure that you have the right coverage for your specific needs.

Premier Homeowners Insurance

Signature Homeowners Insurance

Condo Insurance

Dwelling Basic

Landlord Flex

Renters Insurance

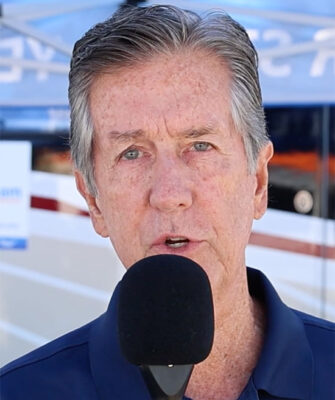

Kudos From Our Customers

“An insurance company that actually cares about its customers. A true unicorn in the insurance industry. After hurricane Matthew, while other insurance companies were praying their phone’s didn’t ring, Security First was calling every single customer in the affected area and asking if they can help. True compassion.”

– Kenneth from Port Orange Florida

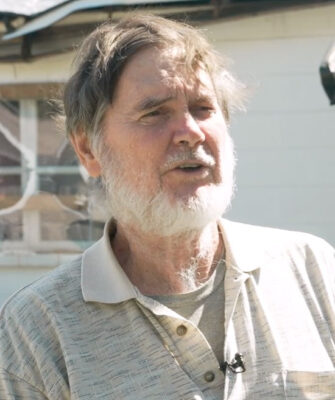

It’s so encouraging to see those that care about their customers and their clients here, trying to help them get a claim started and get their lives back in order.

I’ve been with Security First for about 10 years. I’m very happy with how the process is moving forward.

By that morning, I already had my claims number, they were already working on people to send out to take care of the tree, tarping the house, and getting an inspector … It’s been a real dream to work with them.

I wouldn’t use anyone else, honestly. It’s been a life-changing experience in terms of insurance.

They contacted us before the storm and after the storm to make sure that we were ok and had a place to go. We’ve recommended them to other people.

I can’t say enough about Security First Insurance. We have friends and family with other companies, and I don’t think they’ve had what we’ve had through every storm, and that means the world.

This is our third hurricane in 13 months, and Security First Insurance has been our homeowner’s insurance through all of them. I’ve had a really good experience.

I have the best insurance company in the state. I know I do. Security First has been a delight to work with. They’re simply the best.

I barely even have time to think about it, and I’m getting another contact from Security First about the next step in the process.

Security First has always come through. There’s security in Security First.

You hear a lot of nightmares with insurance companies, but this was not one of them. Thank you Security First.

I was shocked how quickly Security First reached out. So very happy we picked Security First for our home insurance.

Protect Your Home Today

We stand behind every policy we write, storm after storm, year after year®.

Our simple and convenient quote process makes it easy for you to get started. Take the first step towards protecting your most valuable asset by requesting a quote today.