Security First’s Premier Home Insurance Plan

Get What You’ve Earned

This coverage isn’t for everyone—this exclusive HO5 policy is catered to Florida homeowners who have a home value of $500,000 – $2.5 million and an excellent credit rating.

Rewarded with Benefits

Coverage enhancements, such as higher special limits for certain classes of personal property and personal injury coverage, come included in this policy.

No Extra Costs

Our premier policy covers lost or misplaced items, such as jewelry, furs, and watches at no extra cost – that’s more bang for your buck!

Exclusive New Coverage

Valuable additional coverages, such as coverage for your equipment, service lines, and lock replacement are also included in our premier policy, giving you that extra peace of mind.

We Have Options

We’ve got you covered, Florida! View all of our insurance products and optional coverages.

Our Premier Home Insurance Plan Includes

Our Premier Homeowners (HO5) policy offers extensive coverage at a competitive price for Florida homeowners with excellent credit. It includes benefits like coverage for personal property loss and Equipment Breakdown and Service Line coverages.

HO5 Coverage for the

Structure of Your Home

Coverage A provides coverage for your home. Your Coverage A limit should reflect the amount it would cost to rebuild your home. This is known as your home’s replacement cost value, which is not the same as the market value of your home. How do you determine the replacement value of your home? We have a special tool called a replacement cost calculator that can help you and your agent determine the replacement value of your home.

Our Premier Homeowners (HO5) program offers Coverage A limits from $500,000 to $2,500,000.

HO5 Coverage for

Other Structures

Coverage B provides coverage for other structures on your property that aren’t attached to your home. An unattached garage, barn, utility shed, or in-ground swimming pool would be considered an “other structure.”

Our Premier Homeowners (HO5) program offers Coverage B limits from 2% to 70% of the Coverage A limit.

If you have an in-ground pool with an attached aluminum screened enclosure you may want to consider adding our optional Limited Screened Enclosure or Carport Coverage endorsement.

HO5 Coverage for

Your Contents

Coverage C provides coverage for your personal property. Furniture, clothing, jewelry, electronics, and appliances are a few examples of personal property items you may want to insure. Our Premier program includes replacement cost coverage, which means there is no deduction for depreciation.

Our Premier Homeowners (HO5) program offers Coverage C limits between 25% and 75% of the Coverage A limit.

You also have the option to exclude this coverage.

Note: Certain classes of property, such as furs, jewelry, and silverware, have a set coverage limit.

If you own items with a value higher than the special limit included in our Premier Homeowners policy, we have an optional Scheduled Personal Property endorsement that can be added to the policy to insure those items at their appraised value.

HO5 Coverage if

Your Home is Uninhabitable

Coverage D provides coverage for the additional living expenses you and your family incur when your home becomes uninhabitable due to a covered loss. This includes the cost of a place to stay, food, and clothing.

The Premier Homeowners (HO5) policy provides a Coverage D limit of 10% of the Coverage A limit.

To ensure our customers have immediate access to the funds they need, we provide them with a pre-paid debit card. This is one of the many solutions we’ve implemented to improve our customers’ experience.

Tip: It’s important to keep all your receipts.

HO5 Coverage for

Personal Liability on Your Property

Coverage E provides coverage that can protect you in situations that may be unforeseen, such as a friend twisting their ankle on a loose step. Liability coverage also covers certain defense costs – even if the lawsuit filed against you is false, groundless, or fraudulent. However, it does not cover liability losses caused by any animals you own or keep.

The Premier Homeowners (HO5) policy offers Coverage E limits of $100,000, $200,000, $300,000, and $500,000.

Tip: If you’re a dog owner, we have an optional Dog Liability Coverage Endorsement that can be added to your policy to provide coverage for bodily injury and property damage caused by your dog (certain restrictions apply).

HO5 Coverage for

Your Medical Payments

Coverage F provides coverage for medical expenses incurred by someone who does not reside in your household and is injured on or by your property.

The Premier Homeowners (HO5) policy offers Coverage F limits of $1,000, $2,500, and $5,000.

Optional Add-Ons

- Scheduled Personal Property

- Identity Theft Protection & Monitoring

- Golf Cart Physical Damage and Liability

- Hurricane Screened Enclosures & Carport

- Dog Liability

Compare Our Plans

Choosing the right coverage can be overwhelming with so many options available. Use the chart below to compare our most popular policies and find the one that fits your needs.

- Premier (HO5)

- Signature (HO3)

- Condo (HO6)

- Landlord Flex (DF3-DL)

- Dwelling Flex (DF3-DO)

- Dwelling Basic (DF1)

† Two-night minimum required (HO6, DF1)

‡ Four-night minimum required (DF3-DL)

‡ Four-night minimum required (DF3-DL)

† Two-night minimum required (HO6, DF1)

- Premier (HO5)

- Signature (HO3)

- Condo (HO6)

- Landlord Flex (DF3-DL)

- Dwelling Flex (DF3-DO)

- Dwelling Basic (DF1)

† Two-night minimum required (HO6, DF1)

‡ Four-night minimum required (DF3-DL)

‡ Four-night minimum required (DF3-DL)

† Two-night minimum required (HO6, DF1)

Additional Services Tailored for Florida Homeowners

Signature Homeowners Insurance

Dwelling Basic

Dwelling Flex

Condo Insurance

Landlord Flex

Renters Insurance

Kudos From Our Customers

“An insurance company that actually cares about its customers. A true unicorn in the insurance industry. After hurricane Matthew, while other insurance companies were praying their phone’s didn’t ring, Security First was calling every single customer in the affected area and asking if they can help. True compassion.”

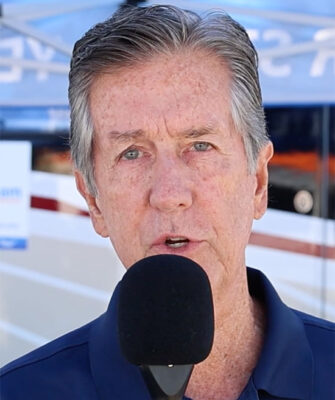

– Kenneth from Port Orange Florida

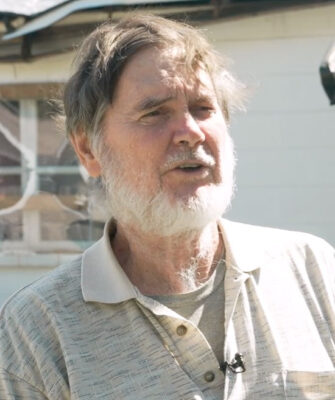

It’s so encouraging to see those that care about their customers and their clients here, trying to help them get a claim started and get their lives back in order.

I’ve been with Security First for about 10 years. I’m very happy with how the process is moving forward.

By that morning, I already had my claims number, they were already working on people to send out to take care of the tree, tarping the house, and getting an inspector … It’s been a real dream to work with them.

I wouldn’t use anyone else, honestly. It’s been a life-changing experience in terms of insurance.

They contacted us before the storm and after the storm to make sure that we were ok and had a place to go. We’ve recommended them to other people.

I can’t say enough about Security First Insurance. We have friends and family with other companies, and I don’t think they’ve had what we’ve had through every storm, and that means the world.

This is our third hurricane in 13 months, and Security First Insurance has been our homeowner’s insurance through all of them. I’ve had a really good experience.

I have the best insurance company in the state. I know I do. Security First has been a delight to work with. They’re simply the best.

I barely even have time to think about it, and I’m getting another contact from Security First about the next step in the process.

Security First has always come through. There’s security in Security First.

You hear a lot of nightmares with insurance companies, but this was not one of them. Thank you Security First.

I was shocked how quickly Security First reached out. So very happy we picked Security First for our home insurance.

Protect Your Home Today

We stand behind every policy we write, storm after storm, year after year®.

Our simple and convenient quote process makes it easy for you to get started. Take the first step towards protecting your most valuable asset by requesting a quote today.