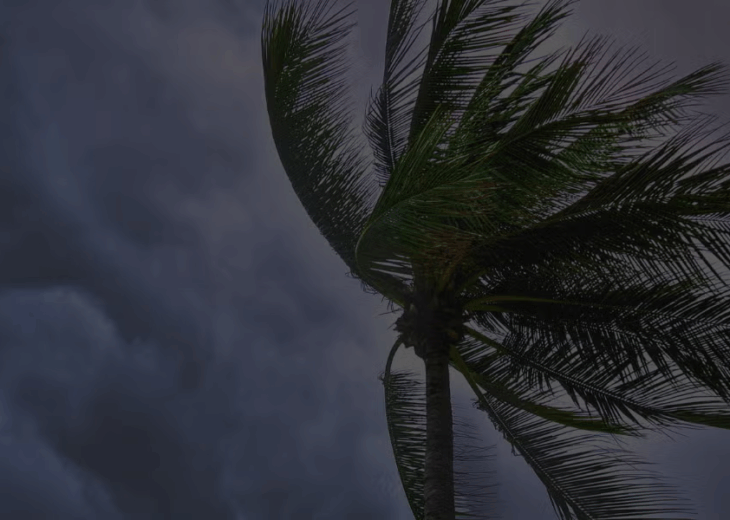

Help Your Home—and Wallet—Stand Up to High Winds

Wind mitigation (also known as opening protection) is your home’s best defense against high-speed storms and hurricane damage in Florida. By helping your home stand up to high winds, wind mitigation also gives you a chance to reduce your homeowners insurance rates while boosting safety. Let’s walk through what it means, why it matters, and how to get started.

Wind mitigation refers to construction features that reduce damage from high winds, especially hurricanes. Wind mitigation evaluates key building features that make your home stronger in high winds, like:

Learn more: Florida Office of Insurance Regulation Wind Mitigation Resources

Why is this worth your time? Homes with verified wind‑resistant features may qualify for insurance premium discounts—often reducing wind‑storm coverage by 10 % to 40 % (sometimes even more).

A licensed inspector fills out Florida’s Uniform Mitigation Verification Form (OIR‑B1‑1802), documenting your home’s eligible features. Most inspections are valid for up to 5 years. Send the form to your agent to unlock the discount.

Once you know where your home stands, consider these upgrades:

Investing in opening protection can lead to significant cost savings in several ways:

Many people think wind-proofing their home is just for hurricane season preparation, but Florida’s tornadoes and summer storms can pack gale-force winds any time of year. By investing in wind mitigation—especially protecting your home’s openings—you can help your home stand up to high winds while gaining real financial benefits.

From lower repair costs and reduced insurance premiums to improved property value and energy efficiency, these upgrades deliver peace of mind and payoffs that last long after storm season. Preparing now means you’re ready for whatever the forecast brings.

Related post: Strengthen Your Home and Save Money on Insurance

Homeowner Tips

Homeowner Tips

Florida winter freeze prep made simple: protect pets, plants, and pipes with smart, homeowner-friendly tips for cold snaps.

Homeowner Tips

Homeowner Tips

Florida doesn’t get snow—but winter is still your best chance to prevent leaks, mold, and insurance headaches. Here’s a quick home check every homeowner should do now.

Florida Lifestyle

Florida Lifestyle

Explore 7 Florida homeowners insurance products tailored to your needs—from condos to rentals to high-value homes. Get a quote today.